Mn paycheck calculator

So the tax year 2022 will start from July 01 2021 to June 30 2022. Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Calculating paychecks and need some help. The Minnesota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Minnesota. Minnesota tax year starts from July 01 the year before to June 30 the current year.

Calculate your Minnesota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. After opening the presentation you need to click the.

Baca Juga

In Minnesota your employer will deduct money to put toward your state income taxes. For example if an employee earns 1500. Simply enter their federal and state W-4 information.

A financial advisor in Minnesota can help you understand how these taxes fit into your overall financial goals. This free easy to use payroll calculator will calculate your take home pay. Just enter the wages tax withholdings and other information required.

Use ADPs Minnesota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. How to calculate annual income. Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the 2022 tax year which means the maximum Social Security tax that each.

The state income tax rate in Minnesota is progressive and ranges from 535 to 985 while federal income tax rates range from 10 to 37 depending on your income. Follow the steps below to. Minnesota Hourly Paycheck Calculator.

Minnesota Salary Paycheck Calculator. Supports hourly salary income and multiple pay. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Minnesota.

Net Pay Calculator PowerPoint Presentation Net Pay Calculator PowerPoint presentation Note for employees with PowerPoint 2007. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Minnesota. You then send this money as deposits to the Minnesota Department of.

Like federal income taxes Minnesota income taxes are. Financial advisors can also help with investing and financial plans including.

Fatal Work Injuries In Minnesota 2020 Midwest Information Office U S Bureau Of Labor Statistics

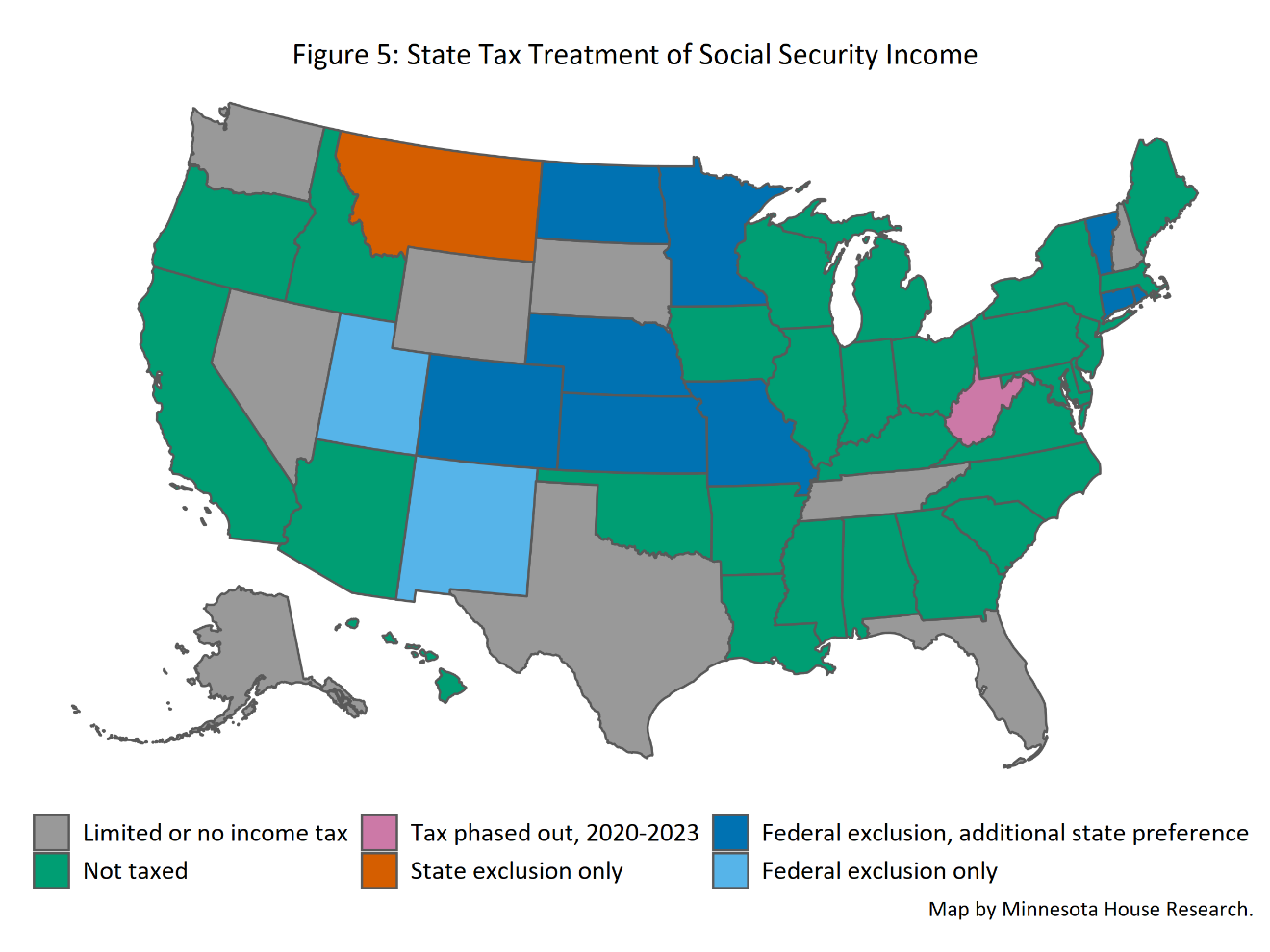

Taxation Of Social Security Benefits Mn House Research

Consumer Price Index Minneapolis St Paul Bloomington Area July 2022 Midwest Information Office U S Bureau Of Labor Statistics

Taxation Of Social Security Benefits Mn House Research

Payroll Tax Calculator For Employers Gusto

Fatal Work Injuries In Minnesota 2020 Midwest Information Office U S Bureau Of Labor Statistics

Hennepin County Mn Property Tax Calculator Smartasset

Minnesota Paycheck Calculator Smartasset

Minnesota Federal Loan Interest Assessment How To Calculate

Taxation Of Social Security Benefits Mn House Research

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Minnesota Paycheck Calculator Smartasset

Minnesota Income Tax Calculator Smartasset

Minneapolis Pay Locality General Schedule Pay Areas

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Taxation Of Social Security Benefits Mn House Research

Hennepin County Mn Property Tax Calculator Smartasset